We invest in quality real estate in resilient sub-markets across major Tier 1 & 2 cities in Europe and Asia Pacific, across all sectors. This is handled by our expert in-house team from end-to-end and leveraging the wider resources of Osborne+Co.

Investment Strategy

End-to-end, hands-on approach from our in-house experts

Our investment strategy

Selecting the right geography

Geographic markets selected through fundamentals analysis such as job growth, diverse composition of economy and employment, currency risk, GDP growth rates, comparable yield analysis, hedging strategies and tourism statistics.

Asset size

Our typical investment size is between £10 million to £50 million per asset.

Protecting downsides and unlocking upsides

Our asset selection process focuses on downside protection and flexibility to create upside and multi-strategy exits; specifically looking at covenant strength, sub-market fundamentals and prospects, alternative uses, sector liquidity and high vacant possession value.

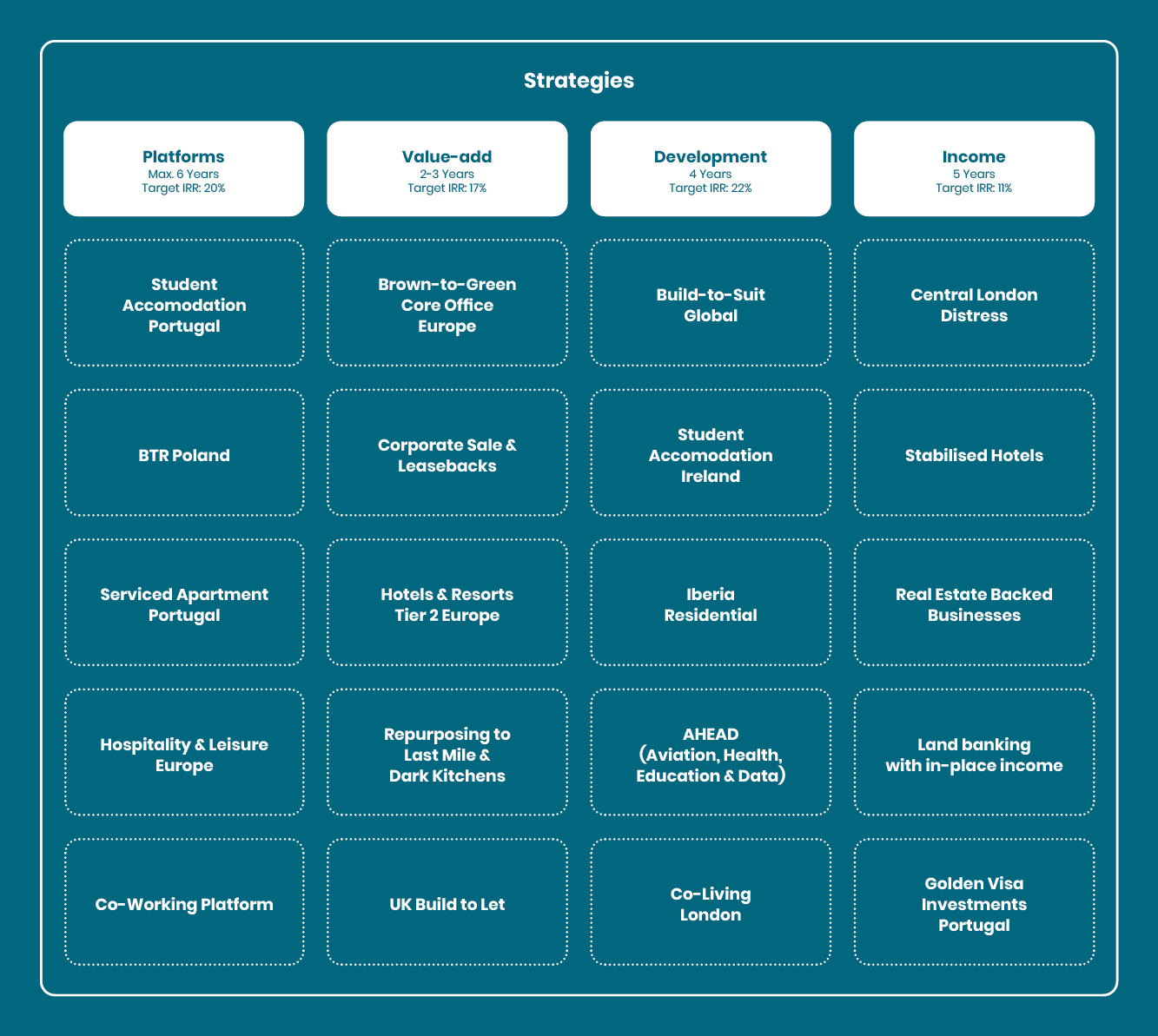

Focus on platforms, value-add, development and income